Chromite in India

Chromite in India

1. Overview:

Chromite (FeCr₂O₄) is the only commercially viable ore of chromium (Cr), a steely-grey, lustrous, hard and brittle metal. Chromium is indispensable due to its resistance to corrosion, oxidation, wear, and galling, and its ability to enhance hardenability. It is mainly used in alloy steel, ferrochrome, and specialty alloys.2. Properties & Applications:

- Chromium imparts hardness, toughness, corrosion resistance, and wear resistance to steel.

- Key applications:

- Metallurgy: Stainless steel, high-speed tool steel, corrosion- and heat-resistant steels.

- Refractory Industry: High temperature stability, chemical neutrality, mechanical strength.

- Chemicals & Pigments: Chromates, bichromates, chromium pigments.

- Other Uses: Chrome plating, trace element in health (minor).

3. Reserves & Resources (2020):

- Total: 332 million tonnes (Mn 79 MT Reserves, 253 MT Remaining Resources)

- Statewise: Odisha dominates (>96% resources, mostly Jajpur, Kendujhar, Dhenkanal), minor deposits in Manipur, Nagaland, Karnataka, Jharkhand, Maharashtra, Tamil Nadu, Telangana, Andhra Pradesh.

- Grades: Charge chrome (28%), Beneficiable (24%), Ferrochrome (17%), Refractory (16%), Unclassified (10%), Low/Other/Not-known (5%).

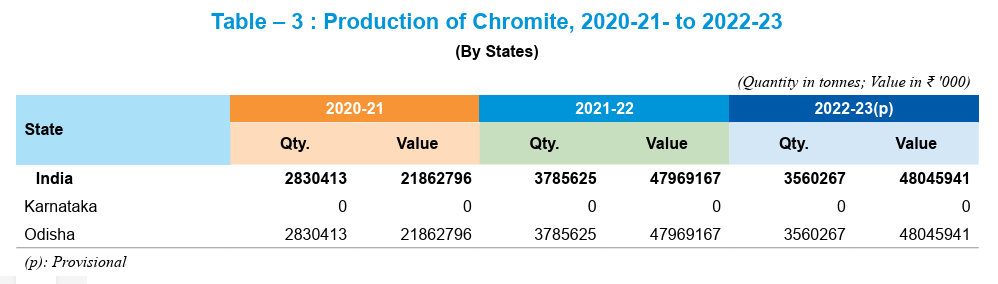

4. Production & Mining (2022-23):

- Total Production: 3.56 million tonnes (↓6% YoY)

- Leading State: Odisha (100% of production)

- Mine-head Closing Stock: 2.94 million tonnes

- Grade Composition:

- 40–52% Cr₂O₃: 43%

- 52%+ Cr₂O₃: 31%

- Below 40% Cr₂O₃: 25%

- Concentrates: 1%

- Employment: 6,435 daily workers (↑ from 4,480)

- Mining Leases: 19 covering 3,293 Ha

5. Industry & Ferroalloy Production:

- Main Products: Ferrochrome (high-, medium-, low-carbon), charge chrome, silicochrome.

- Major Producers: Ferro Alloys Corp. Ltd, Tata Steel, IMFA, Balasore Industries Ltd, Indian Metals & Ferro-Alloys Ltd.

- Production Requirements: ~2.5 tonnes chromite + ~4,500 kWh electricity → 1 tonne ferrochrome.

- Use in Steel: Chromium content in alloys ~60–70%; carbon classifies high (6–8%), medium (3–4%), low (1.5–3%) ferrochrome.

6. Trade & Foreign Relations (2022-23):

- Exports: 33.82 thousand tonnes (↑ from 2.62 thousand tonnes), mainly to China; ferrochrome/ chromium & alloys mainly to USA (74%).

- Imports: 111.29 thousand tonnes (↓55% YoY), mainly from South Africa (72%), Mozambique (23%), Turkey (3%).

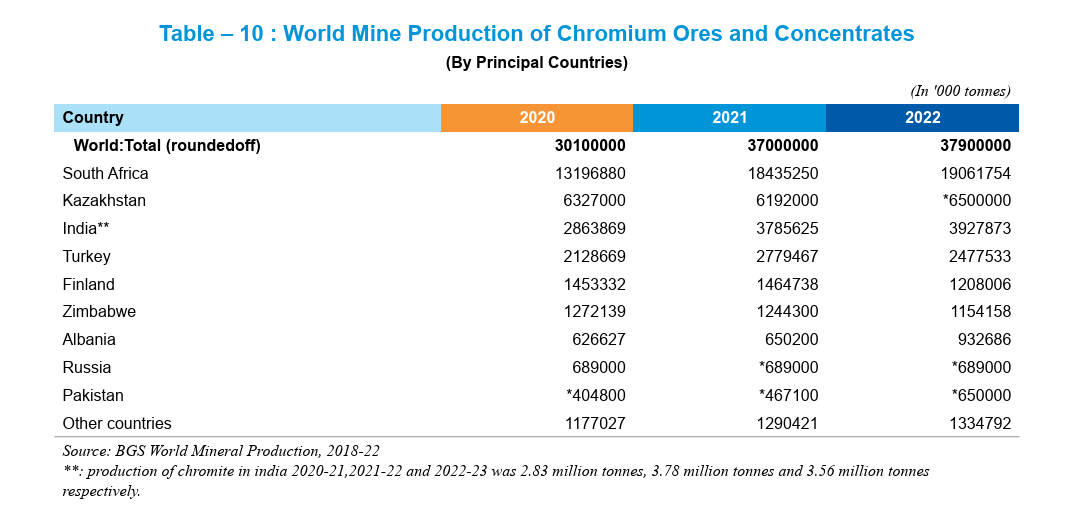

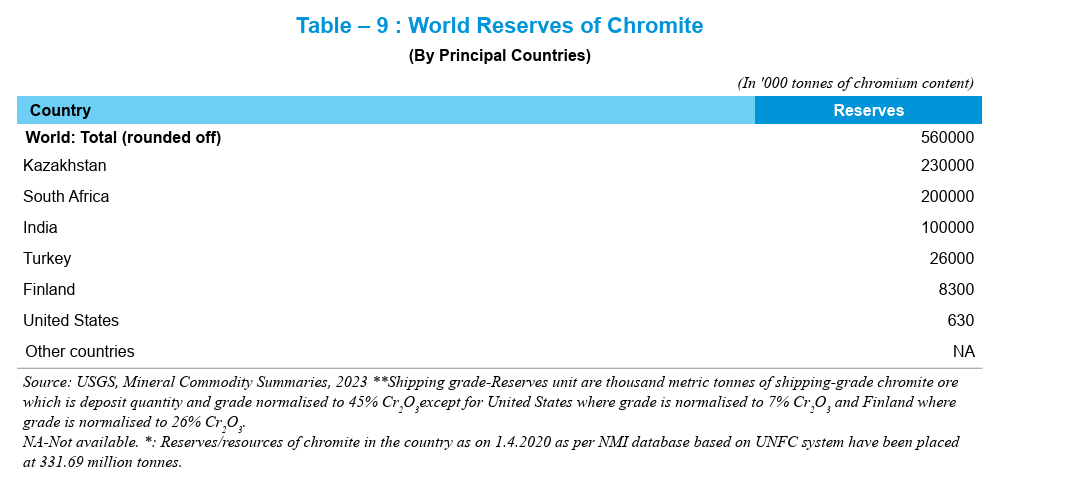

7. Global Scenario:

- Reserves: 560 MT (Shipping-grade) – South Africa (36%), Kazakhstan (41%), India (18%), Turkey (4%).

- Production: 37.9 MT (2022), top producers: South Africa (50%), Kazakhstan (17%), India (10%).

- Technology Trends: Ore beneficiation, pre-reduction, closed-furnace technology, recovery from slags.

8. Substitutes & Constraints:

- Substitution limited: Chromium has no substitute in stainless steel and superalloys.

- Possible substitutes in minor applications: boron, manganese, nickel, molybdenum, dolomite (refractories), cadmium yellow (pigments, not environmentally friendly).

- Challenges: Cost, energy-intensive ferrochrome production, consistent ore and power supply, strict environmental norms.

9. Future Outlook:

- Growing demand in stainless steel and specialty alloys may increase domestic consumption.

- India may continue to rely on imports for high-grade chromite.

- Key concerns:

- Detailed exploration in Odisha, Karnataka, NE ophiolite belts.

- Technological upgrades to reduce energy consumption.

- Sustainable and environmentally compliant mining & processing.

Source : IBM 2023 (Ministry of Mines )

Updated - 6 Oct 2025 ; 10:30 AM