INDIA’S EXTERNAL SECTOR: RESILIENCE AMID GLOBAL HEADWINDS

INDIA’S EXTERNAL SECTOR: RESILIENCE AMID GLOBAL HEADWINDS

(Economic Survey 2024–25 Analysis )

Context

The Economic Survey 2024–25 highlights India’s strong external sector performance despite global headwinds such as geopolitical tensions, protectionist trade policies, and disruptions in major shipping routes. The Survey projects optimism, noting India’s growing global trade footprint, stable external debt position, and sustained investor confidence.

1. EXPORT PERFORMANCE

- Overall growth: Total exports (merchandise + services) grew 6% in the first nine months of FY25.

- Non-oil & non-gems exports: Grew 10.4%, showing resilience in manufacturing, agriculture, and services.

- Imports: Increased 6.9%, indicating stable domestic demand.

- Key challenges:

- Red Sea crisis, Ukraine war, and Panama Canal drought disrupting supply chains.

- Rising protectionism — NTMs (Non-Tariff Measures) now cover 67.1% of global trade, especially agriculture, manufacturing, and natural resources.

2. SERVICES EXPORTS – INDIA’S GLOBAL EDGE

- India’s share in global services exports: Doubled from 1.9% (2005) to 4.3% (2023).

- IT & digital services: India holds 10.2% global share (2nd largest exporter).

- Other business services: 7.2% share (3rd largest), reflecting strengths in consulting & professional services.

- Future potential:

- Growth in e-commerce exports, tourism, and transport services.

- Global Capability Centres (GCCs) and AI-driven digital services as emerging drivers.

3. POLICY INITIATIVES TO BOOST EXPORTS

- Trade Connect e-Platform (DGFT):

- Single-window digital interface for MSME exporters.

- Developed with EXIM Bank, MSME Ministry, MEA, and DFS.

- Aims to reduce information asymmetry and improve market access.

- Infrastructure push: Development of logistics hubs, multimodal connectivity, and policy reforms under PM Gati Shakti to enhance supply chain efficiency.

- FTA strategy:

- UAE-India CEPA (2022) boosted textile exports.

- Ongoing negotiations with EU and UK to expand market access.

- Focus on export basket diversification and new markets.

4. FOREIGN DIRECT INVESTMENT (FDI)

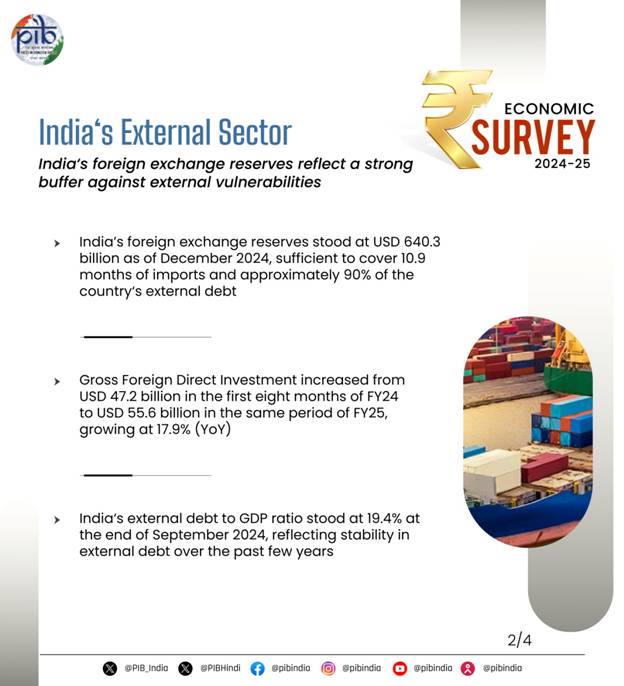

- Gross FDI inflows: Rose from USD 47.2 bn (Apr–Nov 2023) to USD 55.6 bn (Apr–Nov 2024) — +17.9% YoY.

- Cumulative FDI (Apr 2000–Sep 2024): Surpassed USD 1 trillion.

- Top sectors (H1 FY25):

- Services (19.1%)

- Computer Software & Hardware (14.1%)

- Trading (9.1%)

- Non-conventional energy (7%)

- Cement & Gypsum (6.1%)

- Interpretation:

- Net FDI dipped due to higher repatriations and disinvestments — not investor pessimism but profit-taking due to India’s buoyant markets.

- Reflects maturity and liquidity of Indian capital markets.

5. FOREIGN PORTFOLIO INVESTMENT (FPI)

- Mixed trend:

- Withdrawals amid high valuations, global tensions, and Chinese slowdown.

- Reversal driven by India’s strong macro fundamentals and growth prospects.

- Indicates global investors’ confidence in India’s stability relative to peers.

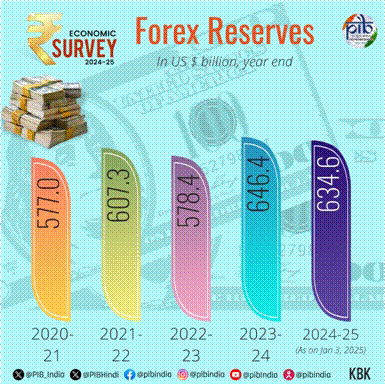

6. FOREIGN EXCHANGE RESERVES

- Forex reserves: USD 640.3 bn (Dec 2024) — covers ~90% of total external debt (USD 711.8 bn).

- Acts as a robust buffer against global volatility.

7. EXTERNAL DEBT STABILITY

- External Debt-to-GDP ratio:

- 19.4% (Sep 2024), up slightly from 18.8% (Jun 2024).

- Debt-to-reserves ratio: Fell from 20.3% → 18.9%, reflecting stronger external position.

- Interpretation: India’s debt sustainability remains sound, enhancing investor confidence.

8. CURRENT ACCOUNT DEFICIT (CAD) & CAPITAL FLOWS

- India continues to run a CAD, reflecting its investment-driven growth model.

- The Survey suggests using foreign savings (FDI/FPI) to supplement domestic savings for capital formation.

- Stresses on:

- Improving investment efficiency.

- Deregulation & Ease of Doing Business to attract long-term FDI.

9. OVERALL ASSESSMENT

| Indicator | 2023–24 | 2024–25 (as per Survey) | Trend |

|---|---|---|---|

| Export Growth | 4% | 6% | ↑ |

| Share in Global Services Exports | 4.0% | 4.3% | ↑ |

| Gross FDI Inflows | USD 47.2 bn | USD 55.6 bn | ↑ |

| Forex Reserves | USD 615 bn | USD 640.3 bn | ↑ |

| External Debt/GDP | 18.8% | 19.4% | Stable |

| External Debt/Reserves | 20.3% | 18.9% | ↓ |

Updated - 12 DEC 2024 3:05 PM | PIB

economic survey 2024-25 india external sector india exports india fdi inflows foreign portfolio investment forex reserves current account deficit external debt balance of payments india trade performance services exports merchandise exports red sea crisis protectionism free trade agreements dgft trade connect platform uae-india cepa india eu trade deal india uk fta ease of doing business global capability centres make in india atmanirbhar bharat global trade headwinds trade diversification logistics infrastructure