LAFFER CURVE

LAFFER CURVE

1. In News

The Laffer Curve is often discussed in debates on tax reforms, fiscal consolidation, and growth-oriented policies.

It resurfaced globally amid post-pandemic fiscal stress and calls for tax cuts to boost growth.

In India, discussions around corporate tax rate cuts (2019) and rationalisation of GST rates reflect Laffer-type reasoning — that lower rates can expand the tax base and increase total revenue over time.

2. Definition

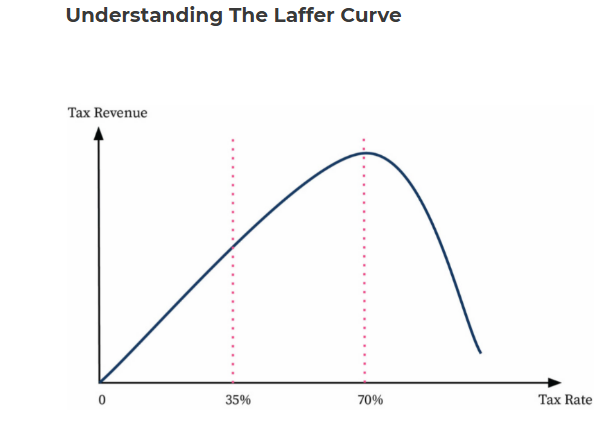

The Laffer Curve is a theoretical representation of the relationship between tax rates and tax revenue.

Proposed by Arthur Laffer (1970s), associated with Supply-Side Economics and Reaganomics (U.S.).

It posits that:

At 0% tax rate, government earns no revenue.

At 100% tax rate, government also earns no revenue (as no one works/invests).

Hence, there exists an optimal tax rate (T)* that maximizes government revenue.

3. Historical Roots

Though popularized by Arthur Laffer, similar ideas appear in Ibn Khaldun’s 14th-century writings and later in Keynesian discussions on tax elasticity.

4. Core Idea

There exists a non-linear (bell-shaped) relationship between tax rates and revenue.

Beyond a point, higher tax rates disincentivize work, investment, and compliance, leading to lower total tax receipts.

Suggests that reducing excessively high tax rates may increase overall tax revenue through higher economic activity.

5. Key Elements

| Element | Description |

|---|---|

| Tax Elasticity | Measures how tax revenue responds to changes in tax rates. |

| Left side of curve | Low tax rates → Increasing rates raise revenue. |

| Right side of curve | High tax rates → Increasing rates reduce revenue. |

| Elastic economy | Small changes in rates → large changes in behavior. |

| Inelastic economy | Behavior relatively unaffected by rate changes. |

6. Immediate vs Long-term Effects

Immediate Effect:

→ Tax cuts cause short-term revenue loss.Long-term Effect:

→ Higher growth, investment, and job creation may broaden tax base and recover lost revenue.

7. Policy Implications

Suggests that tax cuts can boost growth — if economy is operating on the “prohibitive” side of the curve (i.e., tax rates are too high).

Used as a justification for supply-side economic policies such as:

Reaganomics (USA, 1980s)

Corporate tax reduction (India, 2019)

Tax rate rationalization to improve compliance under GST.

8. Criticism

Oversimplified: Ignores complex determinants of tax revenue (e.g., income distribution, compliance, loopholes).

Static view: Doesn’t fully capture dynamic feedback of taxes on growth and productivity.

Assumes rational behavior: Real economies face compliance costs, fairness issues, and inequality effects.

Ignores expenditure side: Focuses only on revenue, not on how government spending impacts growth.

Empirical ambiguity: Ideal tax rate varies across countries, sectors, and time periods.

9. Economic Growth & Tax Elasticity

Economic growth shifts the entire curve upward — as output and income rise, potential tax revenue increases even at the same rate.

High elasticity: Small rate cuts lead to large boosts in taxable activity → strong case for tax cuts.

Low elasticity: Behavior doesn’t change much → tax cuts mainly reduce revenue.

10. Relevance for India

Corporate Tax Cut (2019): Reduction from 30% to 22% aimed at stimulating investment; early revenue dip but potential long-term expansion.

GST Rationalisation: Simplifying structure may enhance compliance and reduce evasion.

Fiscal Consolidation: Must balance growth incentives with adequate revenue for social and infrastructure spending.