9 Years of Stand-Up India – Turning Aspirations into Achievements

IN NEWS

9 Years of Stand-Up India – Turning Aspirations into Achievements

ANALYSIS

1. Context

- Launched on 5 April 2016, the Stand-Up India Scheme aims to empower SC, ST, and women entrepreneurs by facilitating bank loans for establishing new enterprises.

- The scheme completes 9 years and continues to play a crucial role in promoting inclusive entrepreneurship and financial empowerment.

2. Overall Growth of the Scheme

- Total amount sanctioned under the scheme increased significantly:

- ₹14,431.14 crore (31 Oct 2018) → ₹61,020.41 crore (17 Mar 2025).

- This rise reflects the expanding outreach and growing acceptance of the scheme across the country.

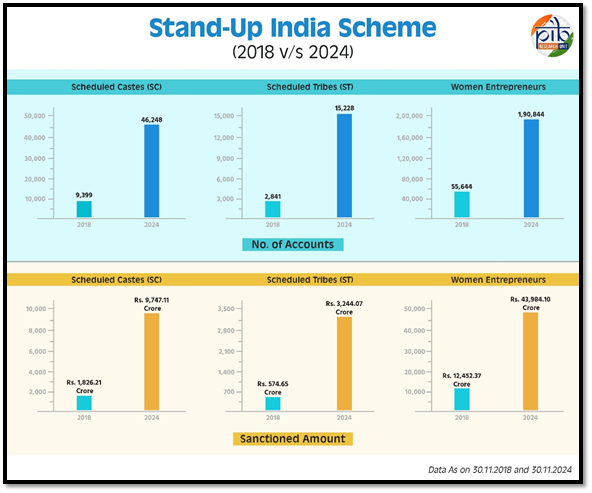

3. Progress Among Target Groups (2018–2024)

- SC Beneficiaries

- Accounts: 9,399 → 46,248

- Sanctioned Amount: ₹1,826.21 crore → ₹9,747.11 crore

- ST Beneficiaries

- Accounts: 2,841 → 15,228

- Sanctioned Amount: ₹574.65 crore → ₹3,244.07 crore

- Women Entrepreneurs

- Accounts: 55,644 → 1,90,844

- Sanctioned Amount: ₹12,452.37 crore → ₹43,984.10 crore

4. Impact and Significance

- The scheme has enabled marginalized groups to access formal credit systems and start entrepreneurial ventures.

- Growth in loan sanctions reflects increased trust, awareness, and institutional support.

- The initiative has contributed to employment generation, income enhancement, and regional economic diversification.

5. Broader Developmental Role

- The scheme supports the goal of inclusive economic growth by bridging credit gaps for traditionally underrepresented groups.

- It fosters a culture of entrepreneurship and contributes to India’s efforts toward social and economic empowerment.

STATIC PORTION (EXAM-RELEVANT)

Stand-Up India Scheme – Key Features

- Launch Year: 2016

- Implementing Agency: Department of Financial Services (DFS), Ministry of Finance

- Objective: To facilitate bank loans between ₹10 lakh and ₹1 crore for SC/ST and women entrepreneurs to set up greenfield enterprises.

- Coverage:

- At least one SC/ST borrower and one woman borrower per bank branch.

- Type of Enterprises Supported:

- Manufacturing, services, or trading sector greenfield projects.

- Handholding Support:

- Assistance for loan application, financial literacy, and entrepreneurship guidance through SIDBI and Stand-Up Connect Centres.

Updated – 05 Apr 2025 ; 12:38 PM | PIBNews Source:PIB