A Decade of Growth with PM Mudra Yojana

IN NEWS: A Decade of Growth with PM Mudra Yojana

ANALYSIS

1. Context

- India completes 10 years of the Pradhan Mantri MUDRA Yojana (PMMY) on 8 April 2025.

- The scheme was launched in April 2015 to “Fund the Unfunded” by providing collateral-free loans to micro and small enterprises.

- It has emerged as a key driver of grassroots entrepreneurship, financial inclusion, and women-led development.

2. Key Achievements

A. Credit Outreach and Expansion

- 52 crore loans sanctioned since 2015 worth ₹32.61 lakh crore.

- Loans enable micro entrepreneurs across sectors such as tailoring, trading, services, repair shops, manufacturing and more.

- PMMY supports non-corporate, non-farm small units that form the base of India’s economic pyramid.

B. Impact on MSME Credit Ecosystem

- MSME lending rose from ₹8.51 lakh crore (FY14) to ₹27.25 lakh crore (FY24); projected to cross ₹30 lakh crore (FY25).

- MSME share of total bank credit rose to ~20% in FY24.

- Growth driven significantly by greater formalisation, accessibility and confidence created by Mudra loans.

C. Women Empowerment

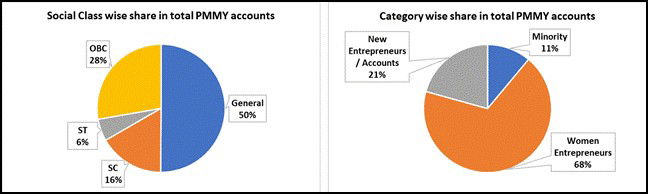

- Women constitute 68% of total Mudra beneficiaries.

- Per woman disbursement rose at a CAGR of 13% (FY16–FY25).

- States with high female disbursement recorded higher employment generation via women-led MSMEs.

- Greater participation supports labour force inclusion and household financial security.

D. Financial Inclusion for Marginalised Communities

- 50% of Mudra accounts belong to SC/ST/OBC entrepreneurs.

- 11% of loan accounts belong to minority communities.

- This indicates strong social inclusion by enabling first-time formal borrowers.

E. Shift from Micro to Small Enterprises

- Kishor loans (₹50,000–₹5 lakh) increased from 5.9% in FY16 to 44.7% in FY25.

- Tarun loans (₹5–10 lakh) also increasing, indicating business scaling.

- Average loan size tripled from ₹38,000 (FY16) → ₹72,000 (FY23) → ₹1.02 lakh (FY25).

F. State/UT-Level Performance

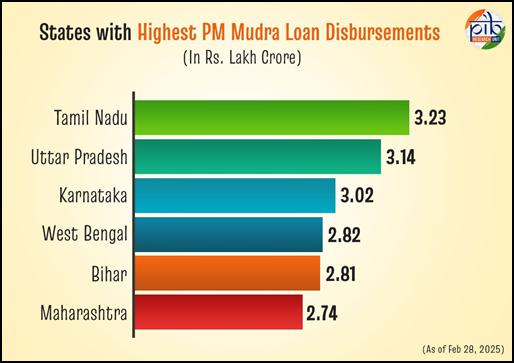

Top Disbursing States (as of 28 Feb 2025)

- Tamil Nadu – ₹3,23,647.76 crore

- Uttar Pradesh – ₹3,14,360.86 crore

- Karnataka – ₹3,02,146.41 crore

- West Bengal – ₹2,82,322.94 crore

- Bihar – ₹2,81,943.31 crore

- Maharashtra – ₹2,74,402.02 crore

Top UT:

- Jammu & Kashmir – ₹45,815.92 crore across 21,33,342 loan accounts.

G. International Recognition

The International Monetary Fund (IMF) acknowledged PMMY in:

- 2017 – Noted strong role in enabling women-led businesses.

- 2019 – Recognised its role in developing and refinancing micro enterprises.

- 2023 – Highlighted growth in women-owned MSMEs (over 2.8 million).

- 2024 – Praised India’s enabling entrepreneurship ecosystem supported by PMMY.

3. Mission and Scheme Design

A. Purpose

- Provide collateral-free institutional credit to micro units.

- Strengthen self-employment and grassroots livelihoods.

B. Implementing Agency

- Micro Units Development and Refinancing Agency (MUDRA) — created by Government of India.

C. Eligible Lending Institutions

- Scheduled Commercial Banks (SCBs)

- Regional Rural Banks (RRBs)

- NBFCs

- MFIs

D. Loan Categories (Interventions)

- Shishu – Up to ₹50,000

- Kishor – ₹50,000 to ₹5 lakh

- Tarun – ₹5 lakh to ₹10 lakh

- Tarun Plus – Above ₹10 lakh to ₹20 lakh (for Tarun beneficiaries with successful repayment)

4. Broader Significance

- PMMY has formalised informal credit for millions.

- Enhanced self-employment, local job creation, and economic decentralisation.

- Created confidence among first-time borrowers, women entrepreneurs, rural youth and socially marginalised groups.

- Strengthened India’s shift from job-seeking to job-creating economy.

STATIC PART (Relevant Concepts)

- MUDRA (Micro Units Development and Refinance Agency) – A government agency that refinances microfinance institutions and banks for lending to micro businesses.

- Collateral-free loans – Loans without security; guaranteed under programmes like Credit Guarantee Fund for Micro Units (CGFMU).

- MSMEs – Micro, Small and Medium Enterprises; major sources of employment and economic output.

- Financial Inclusion – Ensuring access to financial services at affordable cost for all sections of society.

- IMF – International Monetary Fund; global institution monitoring financial stability, growth and economic policy.