Bauxite in India

Bauxite in India

Basic Facts (Prelims Focus)

- Definition: Bauxite = aluminous rock containing hydrated aluminium oxides (gibbsite, boehmite, diaspore) + iron oxide (hematite/goethite) + silica (clay/quartz) + titania (rutile/leucoxene).

- Main Use: Principal ore of aluminium; also used in refractory, cement, chemical industries.

Reserves & Resources

- Total (as on 1.4.2020): 4,958 MT (646 MT proved reserves, 4311 MT remaining resources).

- By Grade:

- Metallurgical grade: ~79%

- Refractory & Chemical grades: ~4%

- By State (share of total resources):

- Odisha – 41%

- Chhattisgarh – 20%

- Andhra Pradesh – 12%

- Gujarat – 8%

- Jharkhand – 6%

- Maharashtra – 5%

- Madhya Pradesh – 4%

Production Trends (2022–23)

- Total production: 23.84 MT (↑ 6% from previous year).

- Mines: 160 reporting mines; 61 producers.

- Top producer: NALCO (31%); PSUs ~46% share.

- Grade-wise production:

- 82% → 40–45% Al₂O₃ grade

- 10% → Cement grade

- 6% → 45–50% Al₂O₃

- Leading state producer: Odisha (73% of national output).

- Employment: Avg. 6,537 persons.

- Leases: 318 leases covering 22,334 ha.

Uses & Specifications

- Aluminium industry: Bayer process (≥40% Al₂O₃).

- Steel industry: Slag corrector (45–54% Al₂O₃, ≤5% SiO₂).

- Refractory industry: IS:10817–1984 standards.

- Chemical & Petroleum industries: IS:3605–1984 standards.

Substitutes

- No large-scale substitute for Al extraction.

- Alternatives for refractory/abrasives: calcined clay, sillimanite, magnesite–chromite, synthetic mullite, silicon carbide (costlier).

- Potential alumina sources: alunite, anorthosite, oil shales, coal wastes.

Trade (2022–23)

- Exports: ↓ 53% to 0.18 MT (mainly to Nepal, Kuwait, Oman).

- Imports: ↑ 20% to 3.6 MT (mainly from Guinea – 88%, Sierra Leone – 9%).

- Policy: Free import/export (no restrictions).

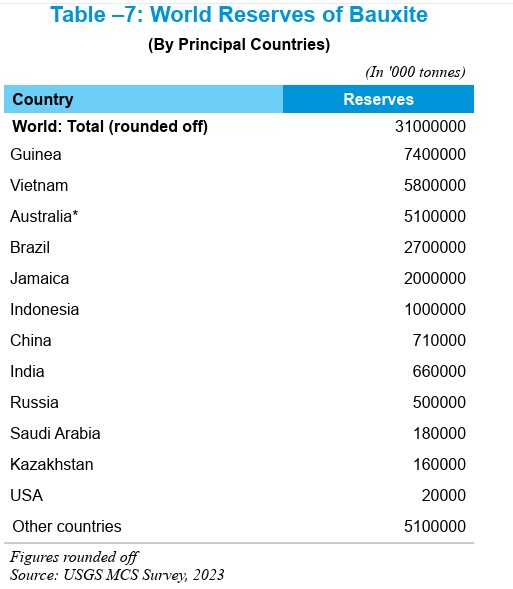

Global Scenario

- World reserves: ~31 BT (2022).

- Major reserves: Guinea (24%), Vietnam (19%), Australia (16%), Brazil (9%).

- India: ~2% of world reserves.

- Top producers (2022): Guinea (26%), Australia (25%), China (19%), Brazil (9%), Indonesia (7%), India (6%).

Future Outlook (India)

- Production to reach ~50.7 MT by 2027 (FITCH estimate).

- Aluminium industry expanding due to:

- Abundant bauxite reserves

- Energy resources (coal-based power)

- Skilled workforce

- Demand drivers: Electric Vehicles, Aviation, Defence, Renewable Energy, Green Buildings, Consumer goods.

- Aluminium critical for clean technologies & sustainable energy systems.

Source : Government of India, Ministry of Mines, Indian Minerals Yearbook 2023

Indian Bureau of Mines, Nagpur, January 2025.

Issued by the Controller General, Indian Bureau of Mines.

Indian Minerals Yearbook 2023 Ministry of Mines Indian Bureau of Mines IBM Nagpur Mineral Resources India Mining Statistics India Mineral Production Data Controller General IBM Mineral Policy India Mines and Minerals 2025 UPSC UPSC Prelims UPSC Mains IAS Exam Civil Services Exam State PCS UPPSC BPSC MPPSC RPSC OPSC UKPSC GPSC MPSC KPSC TNPSC WBPSC SSC SSC CGL SSC CHSL CDS Exam CAPF Exam IES Exam