Budget 2025-26: Fuelling MSME Expansion

In News

The Union Budget 2025–26 has placed strong emphasis on strengthening the Micro, Small and Medium Enterprises (MSME) sector—acknowledging it as a pillar of inclusive economic growth, employment generation, and exports.The Budget introduces major policy measures to expand access to credit, raise classification limits, boost labour-intensive sectors, and support first-time entrepreneurs, particularly from disadvantaged communities.

Background: MSME Landscape in India

| Parameter | Data |

|---|---|

| Registered MSMEs (Udyam Portal) | 5.93 crore |

| Employment generated | 25+ crore individuals |

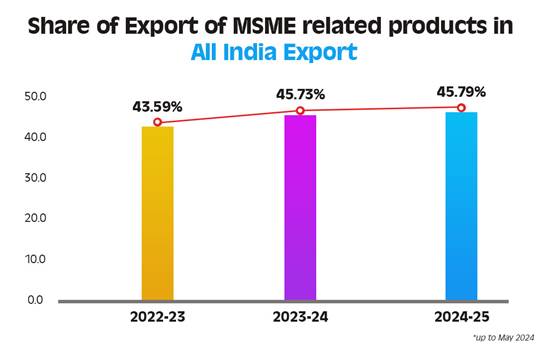

| Share in India’s exports (2023–24) | 45.73% |

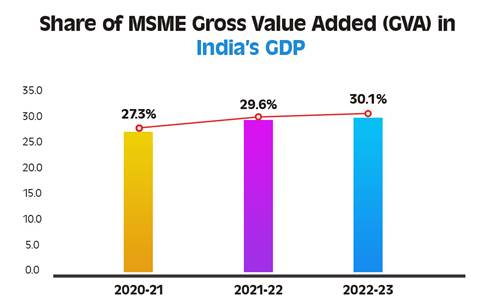

| Share in GVA (2022–23) | 30.1% |

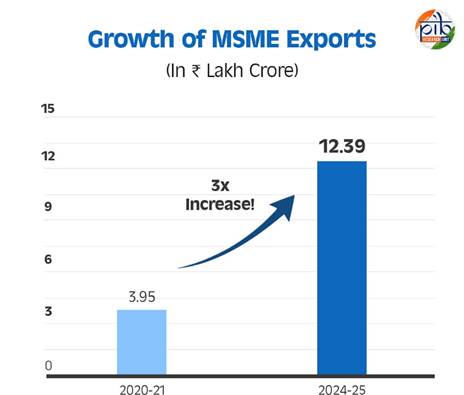

| MSME exports | ₹12.39 lakh crore (2024–25) |

Significance:

MSMEs are vital to India's manufacturing base, self-employment generation, rural industrialization, and Atmanirbhar Bharat vision.

Key Budgetary Announcements for MSMEs (2025–26)

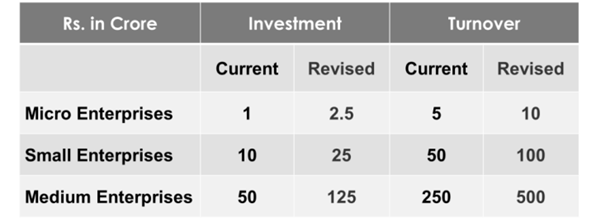

1. Revised Classification Criteria

- Investment limit increased by 2.5 times and turnover limit by 2 times.

- Objective: enable MSMEs to scale operations, adopt advanced technologies, and create more jobs.

→ Significance: Prevents premature graduation from MSME category and encourages sustained expansion.

2. Enhanced Credit Availability

- Credit Guarantee cover for Micro & Small Enterprises: ₹5 crore → ₹10 crore (additional ₹1.5 lakh crore credit over 5 years).

- Startups: Guarantee cover doubled to ₹20 crore, with reduced fees.

- Exporter MSMEs: Access to term loans up to ₹20 crore with enhanced guarantee.

- Credit Cards for Micro Enterprises: ₹5 lakh credit limit for 10 lakh micro units via Udyam portal.

→ Impact: Expands access to formal credit and reduces dependency on informal lending—especially for rural & micro enterprises.

3. Focus on Inclusive Entrepreneurship

- Fund of Funds (₹10,000 crore) to promote startups and innovation.

- Scheme for first-time entrepreneurs (Women, SC/ST): Term loans up to ₹2 crore for 5 years, inspired by Stand-Up India.

→ Impact: Encourages social inclusion, first-generation entrepreneurship, and women-led growth.

4. Support to Labour-Intensive Sectors

- Footwear & Leather Sector:Focus Product Scheme to support design, non-leather production & component manufacturing.

- Expected: 22 lakh jobs, ₹4 lakh crore turnover.

- Toy Sector: Cluster development & skilling for global market competitiveness.

- Food Processing: New National Institute of Food Technology, Entrepreneurship & Management in Bihar.

→ Impact: Employment generation, regional development, and diversification of exports.

5. Manufacturing & Clean-Tech Mission

- National Manufacturing Mission: Policy roadmap for small, medium & large industries.

- Clean-Tech Focus:Incentives for domestic manufacturing of

- Solar PV cells

- EV batteries

- Wind turbines

- High-voltage transmission equipment

→ Impact: Strengthens India’s push for green industrialisation, energy security, and global competitiveness.

6. Budgetary Allocation Trend (₹ Crore)

| Year | Budget Estimates | Revised Estimates |

|---|---|---|

| 2022–23 | 21,422 | 23,628 |

| 2023–24 | 22,137 | 22,138 |

| 2024–25 | 22,137 | 17,307 |

| 2025–26 | 23,168 | — |

📊 Sustained allocation growth reflects renewed fiscal commitment to MSME revival post-COVID.

Supporting Flagship Schemes

| Scheme | Objective | Key Highlights |

|---|---|---|

| PM Vishwakarma | Support artisans & traditional craftspeople | ₹13,000 crore outlay (2023–28), 2.65 crore applications |

| Udyam Portal | Simplified registration for enterprises | 5.93 crore MSMEs registered |

| PMEGP | Credit-linked subsidy for micro-enterprises | 89,118 enterprises supported in 2023–24; 7.1 lakh jobs |

| SFURTI | Cluster development for traditional industries | 376 functional clusters; 2.2 lakh artisans |

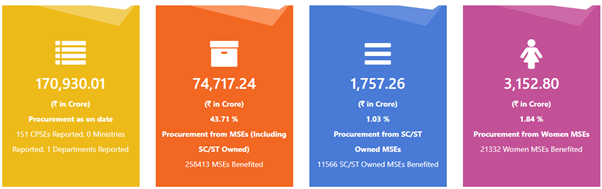

| Public Procurement Policy (2012) | 25% of CPSE purchases reserved for MSEs | ₹74,717 crore procurement (2023–24); 43.71% share |

Analytical Insights

1. Economic Implications

- Boosts credit penetration and formalisation in the MSME sector.

- Enhances export competitiveness and manufacturing base under Make in India.

- Strengthens regional industrial clusters, especially in Tier-II & Tier-III cities.

2. Social & Inclusive Growth

- Promotes women-led and SC/ST entrepreneurship, aligning with Sabka Saath, Sabka Vikas.

- Encourages first-generation entrepreneurs through easier credit and training.

3. Governance & Policy Reform

- Integration of schemes like Udyam Assist, Vishwakarma, and PMEGP marks a whole-of-government approach.

- The credit card initiative for micro enterprises mirrors global best practices in SME financing.

Challenges Ahead

- Credit Absorption Gap: Despite reforms, many MSMEs lack collateral or credit history.

- Delayed Payments: Cash flow disruptions due to pending dues from PSUs and corporates.

- Technology Upgradation: Need for digital adoption and R&D incentives.

- Informal Sector Integration: Over 80% of micro enterprises remain unregistered.

- Market Access: Export compliance and logistics bottlenecks still hinder scale.

Way Forward

- 📌 Strengthen digital credit ecosystems via Udyam + Account Aggregator framework.

- 📌 Ensure timely payments under MSME Samadhan and TReDS platforms.

- 📌 Promote cluster-based skilling and local value addition.

- 📌 Expand green finance and sustainability-linked loans for MSMEs.

- 📌 Institutionalise data-driven monitoring for scheme evaluation.

🪶 Conclusion

The Union Budget 2025–26 marks a decisive shift from recovery to resilience for India’s MSME sector.

By enhancing access to credit, supporting first-time entrepreneurs, and focusing on manufacturing and clean-tech, the Budget aims to empower local enterprises to compete globally.If effectively implemented, these measures could turn MSMEs into the engine of India’s $10-trillion economy vision — driving innovation, employment, and inclusive growth.

Updated - 04 FEB 2025 5:27 PM | PIB