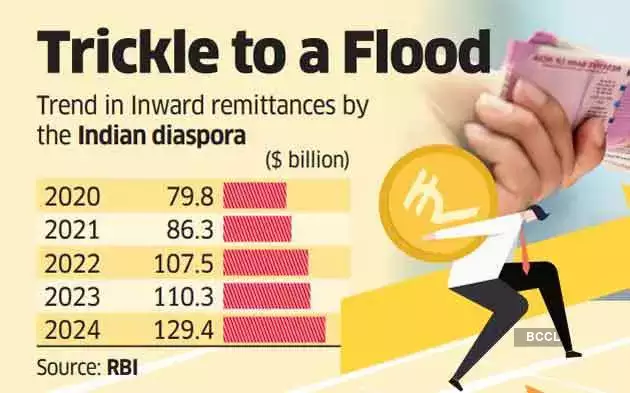

India receives over $100 billion remittances for three consecutive years

India’s Remittance Landscape Shifts: FY24 Highlights

Context

India remains the world’s largest recipient of remittances, receiving $129.4–135.46 billion in FY24. This is the third consecutive year that inflows crossed $100 billion, marking a steady upward trajectory since the pandemic. Remittances now account for a stable and significant source of external financing, complementing FDI and exports.

1. Changing Remittance Sources

- Advanced economies now contribute >50% of remittances, reflecting a shift from traditional Gulf sources.

- Top 10 source countries (FY24):

| Rank | Country | Share of Remittances (%) |

|---|---|---|

| 1 | United States | 27.7 |

| 2 | United Arab Emirates | 19.2 |

| 3 | United Kingdom | 10.8 |

| 4 | Saudi Arabia | 6.7 |

| 5 | Singapore | 6.6 |

| 6 | Qatar | 4.1 |

| 7 | Kuwait | 3.9 |

| 8 | Canada | 3.8 |

| 9 | Oman | 2.5 |

| 10 | Australia | 2.3 |

Trend Analysis:

- US: Dominates due to skilled white-collar Indian professionals.

- UAE & GCC: Historically largest contributors, now showing slower growth.

- Singapore, Canada, Australia: Rising shares reflect skilled migration to advanced economies.

2. Drivers of Growth

- Skilled migration: IT, healthcare, finance professionals to US, UK, Canada, Singapore.

- Digital & banking infrastructure: Facilitates remittance transfers efficiently.

- Economic resilience of source countries: Job recovery post-COVID, despite inflationary pressures.

- Global employment patterns: GCC largely blue-collar, advanced economies largely white-collar → higher per capita remittance from US/UK.

3. Economic Implications

- Non-debt financial inflows: Strengthen current account and FX reserves.

- Household income support: Funds family maintenance, education, and healthcare.

- Complement to FDI & services exports: Over 40% of gross current account inflows.

- Macroeconomic stability: Provides a buffer during global shocks (pandemic, inflation, geopolitical tensions).

4. Trends & Projections

- Remittances have more than doubled since 2010–11 ($55.6 billion).

- India’s share in global remittances: 11% (2001) → 14% (2024).

- Projected to reach $160 billion by 2029 (RBI).

- Growth reflects India’s global human capital strength and diaspora networks.

5. Conclusion

India’s remittance inflows demonstrate a structural shift from GCC dependence to advanced economies, driven by skilled migration and professional diaspora networks. These inflows provide stable, non-debt external financing, enhance household incomes, and strengthen macroeconomic stability, positioning India as a resilient, globally integrated economy.

Updated: Apr 17, 2025, 12:22:29 PM | ET