India’s FDI Milestone – $1 Trillion Inflows Since April 2000

India’s FDI Milestone – $1 Trillion Inflows Since April 2000

(PIB, 12 Dec 2024

Context

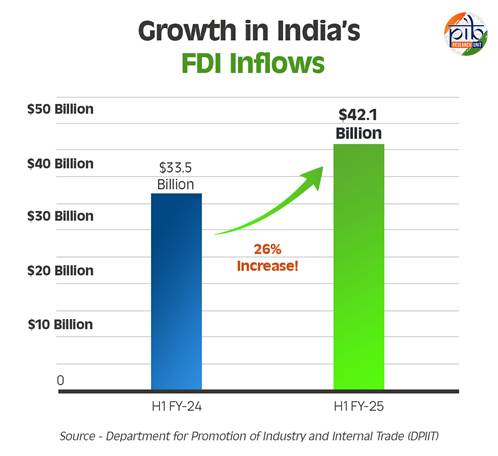

India has achieved a cumulative FDI inflow of $1 trillion since April 2000, highlighting its emergence as a global investment hub. In the first half of FY25, FDI surged 26% to $42.1 billion, underscoring strong investor confidence.

1. Historical Perspective

- 2014–2024: FDI inflows of $709.84 billion (~69% of cumulative FDI in 24 years).

- Demonstrates accelerated investment attraction over the last decade compared to earlier years.

2. Key Drivers of FDI Growth

A. Competitiveness & Innovation

- World Competitiveness Index 2024: India ranked 40th (up 3 positions from 2021).

- Global Innovation Index 2023: India ranked 40th, up from 81st in 2015.

- Reflects strong innovation ecosystem, IT capabilities, and R&D progress.

B. Global Investment Standing

- Third largest recipient of greenfield projects: 1,008 projects (World Investment Report 2023).

- Second largest for international project finance deals, up 64%.

- Positions India as a key player in global capital allocation.

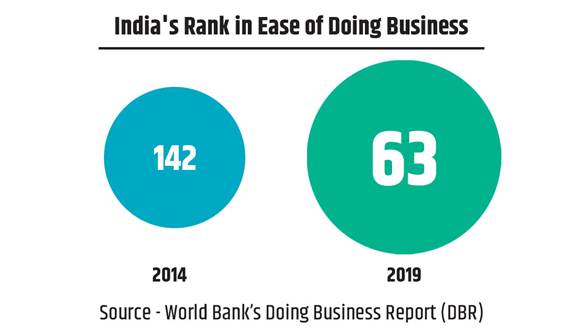

C. Improved Business Environment

- World Bank Doing Business Report: Jumped from 142nd (2014) → 63rd (2020).

- Indicates regulatory simplification, ease of starting businesses, and investor-friendly policies.

D. Policy Reforms

- Automatic route FDI: Most sectors open for 100% FDI.

- Tax reforms (2024): Angel tax abolished; reduced tax rates for foreign companies.

- Sectoral focus: Liberalisation of space, defence, and tech-driven sectors.

3. Significance

- Non-debt capital: Reduces dependency on foreign borrowing.

- Technology transfer & skill development: Boosts manufacturing and innovation.

- Employment generation: Across MSMEs and high-tech sectors.

- Global credibility: Positions India as a stable, long-term investment destination.

4. UPSC Relevance

Prelims:

- Total FDI since 2000: $1 trillion

- FDI inflows in H1 FY25: $42.1 billion

- Key global rankings: Competitiveness 40th, Innovation 40th

Conclusion

India’s FDI journey reflects policy stability, strategic reforms, and global investor confidence. Sustaining this momentum requires continued focus on ease of doing business, innovation-led growth, and sectoral liberalisation, positioning India as a major player in the global investment landscape.

Updated - 12 DEC 2024 5:05 PM | PIB