Indian Iron & Steel Industry

Indian Iron & Steel Industry

Context

India’s steel sector — a key driver of industrial growth and modernization — has recorded significant expansion, emerging as the 2nd largest crude steel producer and largest sponge iron producer globally (2022–23).

Key Facts & Figures

1️⃣ Production Highlights (2022–23)

- Crude Steel: 127.19 million tonnes (↑5.7% over 2021–22)

→ Capacity: 161.23 MT | Utilisation: 78.85% - Finished Steel:123.19 MT (Crude Steel Equivalent)

- Non-alloy: 113.52 MT

- Alloy: 6.87 MT

- Stainless: 2.77 MT

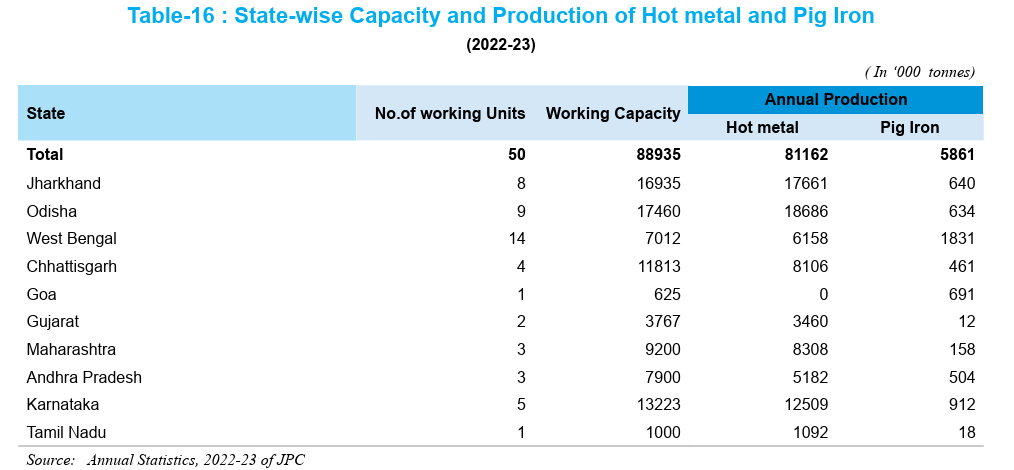

- Hot Metal: 81.16 MT (↑3.8%)

- Pig Iron: 5.81 MT

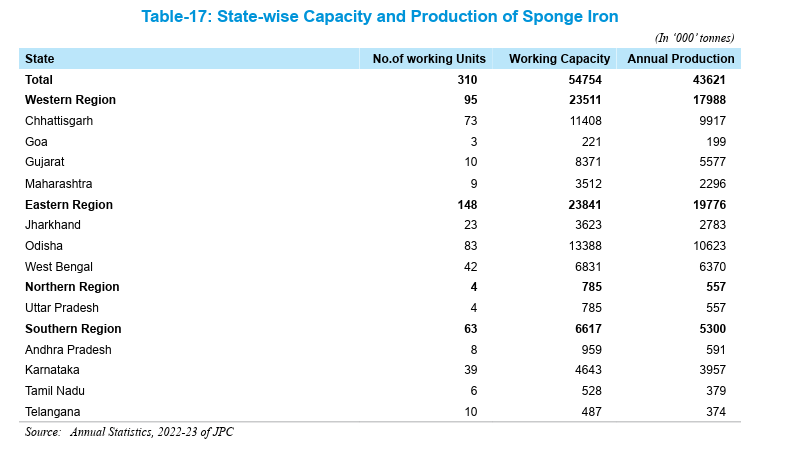

- Sponge Iron: 43.62 MT (↑11.3%) → India = World’s Largest Producer

2️⃣ Structural Overview

- Private Sector: 82% share in crude steel output (104.76 MT)

- Public Sector: Major producers – SAIL, RINL

- Top Private Producers: Tata Steel, JSW, JSPL, AM/NS, Essar

3️⃣ Major Production Routes

| Route | Units | Capacity (MT) | Production (MT) | Utilisation |

|---|---|---|---|---|

| BF/BOF (Oxygen Route) | 18 | 67.29 | 58.79 | 87% |

| EAF (Mini Steel Plants) | 34 | 36.60 | 28.20 | 77% |

| IF (Induction Furnace) | 887 | 57.39 | 40.20 | 70% |

🧩 Induction route fastest growing → low-cost production, regional market supply.

4️⃣ Exports & Imports (2022–23)

- Exports: 6.71 MT (↓25% in value → ₹1.53 lakh crore)

→ Main Destinations: USA (18%), Italy (9%), UAE (6%), Nepal (5%) - Imports: 6.02 MT (↑46% in value → ₹1.70 lakh crore)

→ Main Sources: China (17%), S. Korea (14%), Japan (8%), Indonesia (7%)

5️⃣ Policy Framework

- 🔹 National Steel Policy (NSP), 2005:

Aim – Modern, self-reliant, globally competitive industry. - 🔹 National Steel Policy, 2017:

Vision 2030 – 300 MT production capacity; promote ‘Make in India’, domestic procurement, and technological upgradation. - 🔹 Steel Scrap Recycling Policy:

→ Ensure quality scrap, reduce imports, save energy & resources.

→ Recycling 1 tonne scrap saves 1.1 t iron ore, 0.7 t coal, and ~17% energy.

6️⃣ Ship Breaking & Scrap Industry

- Main Hub: Alang–Sosiya (Gujarat) – 98% of India’s ship recycling.

→ Capacity: ~450 ships/year → >4.5 MT re-rollable steel. - Contribution: 1–2% of domestic steel demand.

- Regulators/Players: MSTC Ltd, Ferro Scrap Nigam Ltd (FSNL).

→ Engage in e-auctions, recycling, and scrap recovery from steel plants.

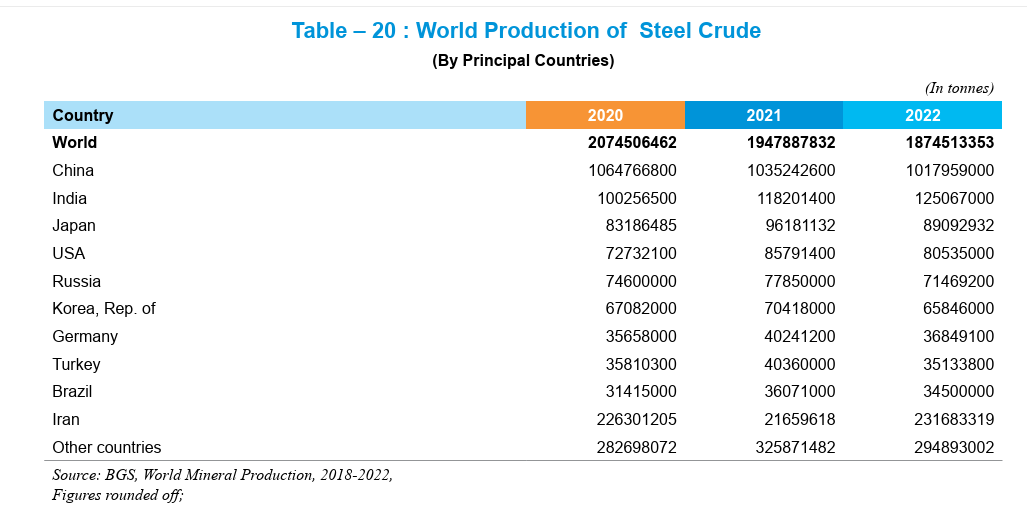

7️⃣ Global Scenario (2022)

- World Pig Iron: 1,414 MT (↓2%) → China 61%, India 8%

- World Crude Steel: 1,874 MT (↓4%)

→ China 54%, India 7%, Japan & USA 4% each

8️⃣ Future Outlook

- Drivers: Urbanization, infra push, manufacturing growth, “Make in India”.

- India:

- 2nd largest crude steel producer

- 3rd largest finished steel consumer

- 1st in sponge iron/DRI production

- Construction sector: ~50% of global steel demand.

- Goal: Environmentally sustainable & globally competitive growth.

Source : Government of India, Ministry of Mines, Indian Minerals Yearbook 2023

Indian Bureau of Mines, Nagpur, January 2025.

Issued by the Controller General, Indian Bureau of Mines.

Updated - 27 Sept 2025 ; 12: 23 PM

Indian Economy Infrastructure Manufacturing Industrial Policy UPSC UPSC Prelims UPSC Mains BPSC MPPSC UKPSC WBCS UPPSC RPSC JPSC TNPSC SSC SSC CGL RRB NTPC Make in India Steel Industry National Steel Policy Scrap Recycling Sustainable Growth Indian Industry Economic Development Circular Economy Eminent IAS