Pradhan Mantri Fasal Bima Yojana Completes Nine Years

IN NEWS: Pradhan Mantri Fasal Bima Yojana Completes Nine Years

ANALYSIS

1. Context

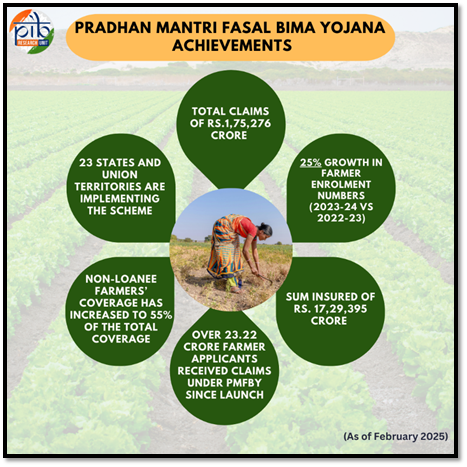

- Pradhan Mantri Fasal Bima Yojana (PMFBY) marks its nine-year completion on 18 February 2025.

- Launched in 2016, aimed at protecting farmers from crop losses arising due to natural calamities.

- PMFBY continues to act as a comprehensive income-stabilisation mechanism for India’s agricultural sector.

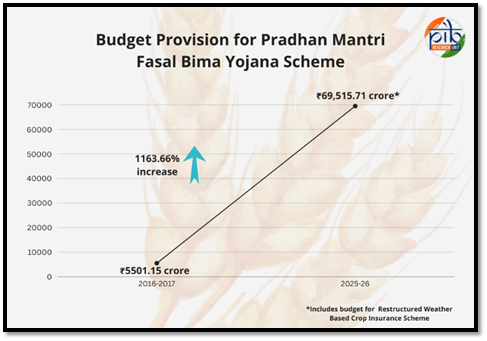

2. Cabinet Approval for Continuation

- In January 2025, the Union Cabinetapproved the continuation of:

- PMFBY

- Restructured Weather Based Crop Insurance Scheme (RWBCIS)

- Approved period: Up to 2025–26

- Total financial allocation: ₹69,515.71 crore.

3. PMFBY vs RWBCIS

- PMFBY:

- Based on actual yield assessment.

- Uses CCEs (Crop Cutting Experiments) for estimating losses.

- RWBCIS:

- Weather index-based insurance.

- Compensation is calculated on the basis of weather triggers such as rainfall, temperature, humidity etc.

- Main difference lies in methodology of admissible claim calculation.

4. Technological Interventions

- Advanced Monitoring Tools:

- Satellite imagery, drones, UAVs, remote sensing for:

- Crop area estimation

- Yield disputes

- Loss assessment

- Planned CCE execution

- Clustering of districts

- Satellite imagery, drones, UAVs, remote sensing for:

- Digital Integration:

- Yield data captured via CCE-Agri App, uploaded to the National Crop Insurance Portal (NCIP).

- State land records integrated with NCIP for enhanced transparency.

- YES-TECH (from Kharif 2023):

- Technology-based yield estimation system.

- Blends manual and technology-driven yield data.

- Aims to reduce reliance on manual CCEs and improve accuracy and timeliness of claim settlement.

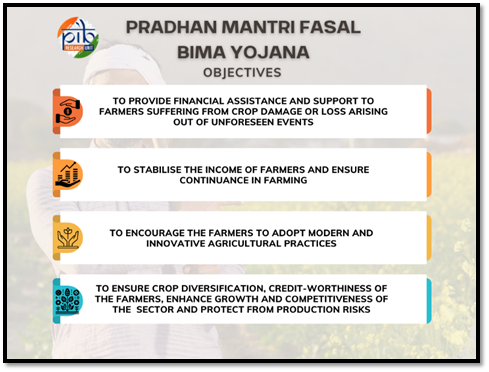

5. Key Benefits of PMFBY

- Affordable Premium Structure:

- Kharif: 2% of sum insured

- Rabi: 1.5%

- Annual commercial/horticultural crops: 5%

- Remaining premium borne by the Government.

- Comprehensive Risk Coverage:

Covers:- Natural calamities (drought, floods, cyclones)

- Pest and disease attacks

- Post-harvest losses (up to 14 days for crops kept in “cut and spread” condition)

- Localised calamities (hailstorm, landslide, inundation)

- Prevented sowing (up to 25% of sum insured)

- Timely Compensation:

- Target: Settlement of claims within two months of harvest.

- Technology-Driven Implementation:

- Ensures accuracy, accountability and transparency.

6. Strengthening PMFBY

- Multiple reforms since 2016 have improved transparency and timeliness.

- 2023–24:

- Highest-ever area and farmer coverage.

- Now the largest crop insurance scheme globally based on farmer applications.

- Several States have waived farmers’ premium share—reducing burden on farmers.

7. Eligibility and Participation

- Scheme is voluntary for all farmers.

- Non-loanee farmers now form 55% of total enrolments (2023–24), indicating high voluntary acceptance.

NECESSARY STATIC PART

- Pradhan Mantri Fasal Bima Yojana (PMFBY)

- Objective: Provide financial support for losses to standing crops due to non-preventable natural risks.

- Implemented by: Ministry of Agriculture & Farmers Welfare.

- Introduced: 2016.

- Crop Cutting Experiments (CCEs)

- Conducted to estimate actual yield of crops in notified insurance units.

- Required for crop insurance loss computation.

- National Crop Insurance Portal (NCIP)

- Digital platform for enrolment, claim processing, CCE data upload and transparency.

- Weather Based Crop Insurance Scheme (WBCIS / RWBCIS)

- Uses objective weather parameters for estimating crop losses.

Updated - 17 Feb 2025 ; 07:25 PM | News Source: PIB (https://www.pib.gov.in/PressReleasePage.aspx?PRID=2104175)