Sukanya Samriddhi Yojana: A Decade of Transforming Lives

IN NEWS — Sukanya Samriddhi Yojana: A Decade of Transforming Lives

ANALYSIS

1. Background and Completion of 10 Years

- Sukanya Samriddhi Yojana (SSY) was launched on 22 January 2015 under the Beti Bachao, Beti Padhao campaign.

- On 22 January 2025, the scheme completed 10 years, marking a decade of promoting financial security and empowerment for girl children.

- Over 4.1 crore SSY accounts have been opened as of November 2024, indicating widespread acceptance and impact.

2. Objectives and Core Purpose

- Ensure long-term financial security for girl children.

- Promote education over early marriage by encouraging planned savings.

- Create social awareness around valuing daughters and enabling a culture of empowerment.

3. Eligibility and Account Opening Provisions

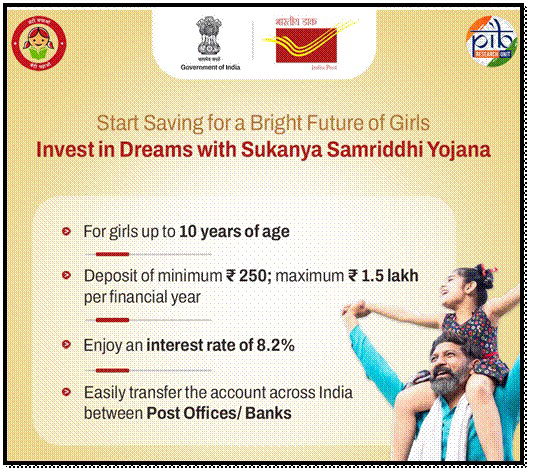

- Account can be opened from birth till the girl turns 10 years.

- The girl child must remain a resident Indian until account maturity/closure.

- Only one account per girl child; maximum two accounts per family, except in cases of twins or triplets.

- Required documents:

- SSY Account Opening Form

- Birth certificate

- Identity proof (RBI KYC compliant)

- Address proof (RBI KYC compliant)

- Account can be transferred anywhere in India.

4. Deposit Rules

- Minimum annual deposit: ₹250; deposits must be in multiples of ₹50.

- Maximum annual deposit: ₹1,50,000; excess amount earns no interest.

- Deposits can be made for 15 years from account opening.

- Account can be opened in any post office or designated bank.

5. Account Operation

- Managed by the guardian until the girl turns 18.

- After 18, the girl can operate the account herself upon submission of required documents.

6. Interest Calculation Mechanism

- Interest is calculated monthly based on the lowest balance between the 5th day and end of the month.

- Credited annually at the end of the financial year.

- Fraction rounding:

- ≥50 paisa → rounded up

- <50 paisa → ignored

- Interest credited irrespective of office transfers.

7. Maturity and Early Closure Rules

- Account matures 21 years from the date of opening.

- Early closure permitted only if the girl intends to marry after turning 18.

- Required for early closure:

- Application + declaration on non-judicial stamp paper

- Proof of age (≥18 at marriage)

- Closure window:

- Within 1 month before marriage

- Up to 3 months after marriage

- Payout includes outstanding balance + applicable interest.

8. Withdrawal Rules for Education

- Up to 50% of the balance from the preceding financial year can be withdrawn.

- Conditions:

- Girl must be 18 years OR

- Must have completed 10th standard

- Purpose: Educational expenses only.

- Documentation required:

- Admission offer letter

- Institutional fee slip

- Withdrawal can be lump sum or in instalments (max 1 per year for 5 years).

9. Premature Closure on Special Grounds

- In case of death of the account holder, the account can be closed immediately.

- Required: Application + death certificate.

- Guardian receives full balance + accrued interest up to date of death.

- Post-death interest is calculated at Post Office Savings Account rate.

- Premature closure also allowed on compassionate grounds, such as:

- Life-threatening medical conditions of the girl

- Death of the guardian

- No premature closure allowed within first 5 years except on death.

10. Overall Assessment

- SSY has emerged as one of India’s most impactful small savings schemes for girl children.

- It supports long-term planning for education, empowerment, and financial independence.

- High participation (4.1 crore accounts) reflects trust, awareness, and behavioural change.

- Acts as a social and financial safety net, complementing national goals of gender equity.

NECESSARY STATIC PART

- SSY is a part of the National Small Savings Schemes.

- Implemented under the Ministry of Women and Child Development + Ministry of Finance (DFS).

- Scheme interest rate is notified quarterly by the Government of India.

- Premature closure principles align with Post Office Savings Scheme Rules.

- SSY offers E–E–E tax benefit under Section 80C (up to ₹1.5 lakh).

Updated – 21 Jan 2025 ; 04:00 PM | PIB | News Source: PIB (https://www.pib.gov.in/PressReleasePage.aspx?PRID=2094807)