Union Minister reviews progress of PM SVANidhi Scheme with States, UTs and Banks

IN NEWS

Union Minister reviews progress of PM SVANidhi Scheme with States, UTs and Banks

ANALYSIS

1. Context

- The Union Minister of Housing and Urban Affairs, Shri Manohar Lal, chaired a comprehensive review meeting on the implementation of the PM SVANidhi Scheme.

- Participants included representatives from 33 States/UTs, MoHUA, DFS, and major banks/SLBC conveners.

2. Key Review Areas

- State-wise Progress Assessment: Evaluation of the pace of implementation across States/UTs.

- Operational Challenges: Issues in awareness generation, vendor identification, application processing, and loan disbursement.

- Disposal of Returned Applications: Emphasis on faster turnaround at ULB and bank levels.

3. Strategic Direction Given by the Minister

- Accelerate Awareness Efforts: Broader outreach to ensure eligible street vendors are identified and motivated to apply.

- Speed Up Loan Sanctions & Disbursements: Banks and ULBs instructed to remove bottlenecks and clear pending cases.

- Move Vendors Across Loan Tranches:

- Facilitate transition from first → second → third tranche.

- Strengthen vendor creditworthiness and livelihood stability.

- Digital Onboarding:

- Ensure 100% saturation of beneficiaries on digital platforms.

- Promote active digital usage by vendors.

- Hygiene & Food Safety Training:

- Mandatory FSSAI training for street food vendors.

4. New Government Initiative

- Launch of a month-long nationwide campaign:

SVANidhi Sankalp Abhiyaan- Duration: 3rd November – 2nd December 2025

- Objective: Enhance outreach, application processing, and saturation by ULBs and banks.

5. Government Commitment

- Continued partnership with States, UTs, ULBs, DFS, and the banking ecosystem.

- Ensuring timely, accessible credit support to street vendors and robust on-ground execution.

STATIC PORTION (EXAM-RELEVANT)

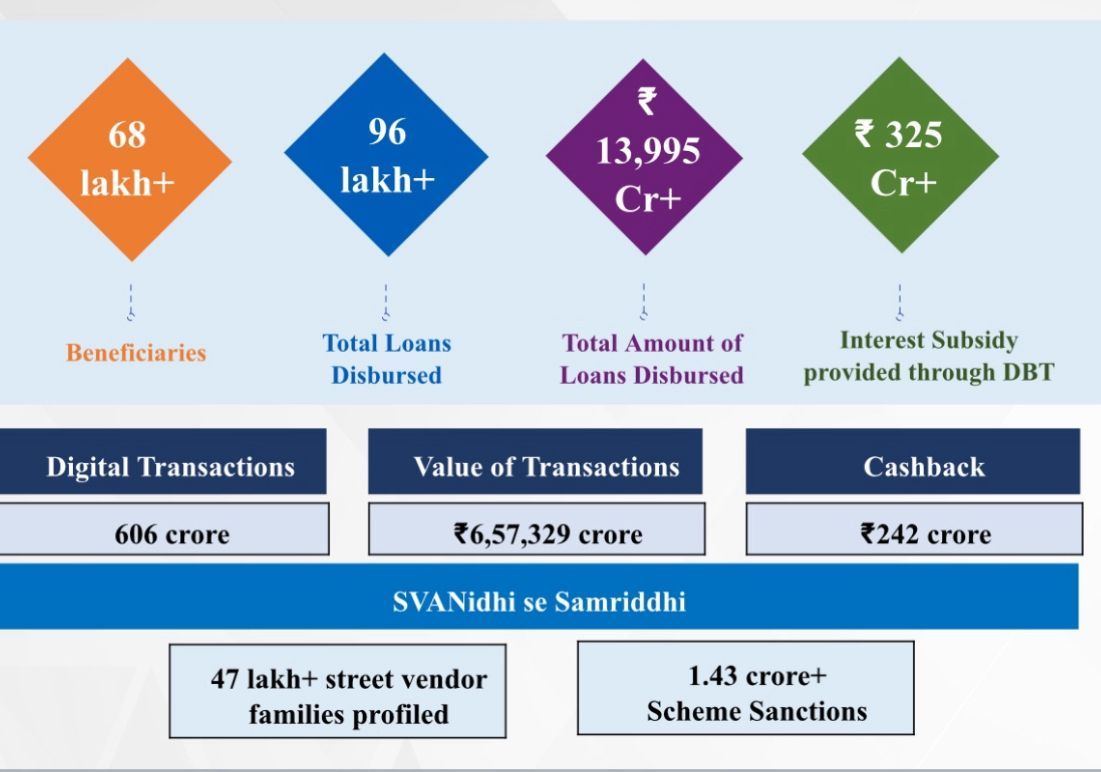

About PM SVANidhi Scheme

- Full Form: Prime Minister Street Vendor’s AtmaNirbhar Nidhi.

- Launched: June 2020.

- Objective: Provide collateral-free working capital loans to street vendors.

- Loan Tranches:

- 1st Tranche: Up to ₹10,000

- 2nd Tranche: Up to ₹20,000

- 3rd Tranche: Up to ₹50,000

- Interest Subsidy: 7% per annum on timely repayment.

- Key Features:

- Incentives for digital transactions.

- Focus on increasing formal credit access for informal sector vendors.

- Coordination between ULBs and banks for implementation.

Updated – 24 Oct 2025 ; 7:16 PM | PIB

News Source:PIB